2x savings to boost your finances

At first glance, Php200 might seem like a modest sum, just a small fraction of your monthly paycheck. Yet, as the saying goes, "Little drops of water make a mighty ocean." Imagine redirecting that same Php200 towards a significant goal – your savings. This perspective aligns perfectly with the Home Development Mutual Fund, or Pag-IBIG Fund, which can serve as a tool to empower Filipinos to save smartly.

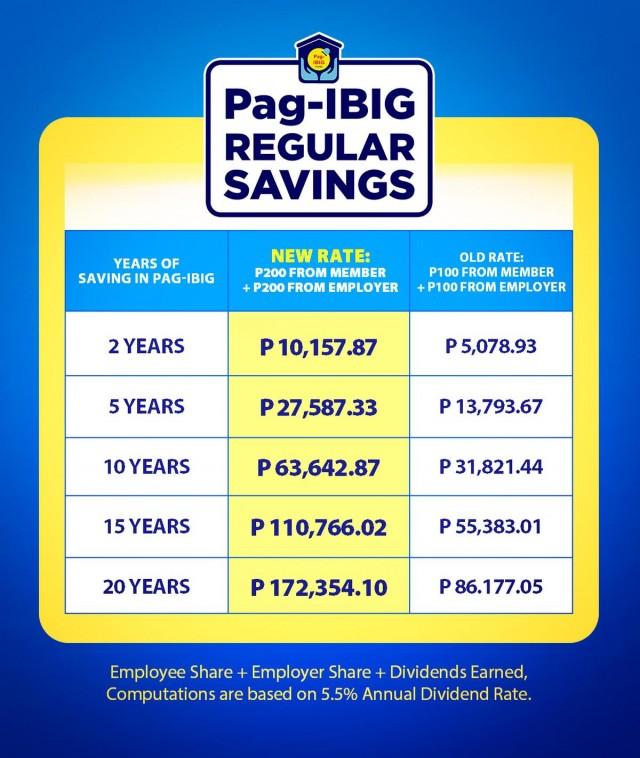

Starting February 2024, Pag-IBIG members can now enjoy double the savings under the agency’s latest rates. The maximum amount used to calculate Pag-IBIG contributions, called the Monthly Fund Salary (MFS), has gone up from P5,000 to Php10,000. This change affects the resulting 2% contribution rate, which is the percentage of your salary that both you and your employer contribute to Pag-IBIG. With the new maximum MFS, you and your employer shall now each put in Php200 per month (2% of Php10,000) instead of the previous Php100. So, a member’s total monthly contribution is now Php400. Check out the table below.

This increased contribution goes into your Pag-IBIG Regular Savings. While it might not seem like much initially, after a year, you'll have saved Php4,800. This change essentially doubles your savings with Pag-IBIG. And what’s more, this shall earn annual dividends, which shall be based on Pag-IBIG’s earnings during the year.

Why does this matter?

The recent increase in savings for Pag-IBIG Fund members comes with some good perks. The bump in savings shall translate to a larger cash loan, helping you gain more funds to achieve your goals or to address emergencies.

That Php200 from your monthly paycheck could also be the key to unlocking homeownership sooner than you think. With more funds to use, Pag-IBIG shall be able to continue financing more home loans at low interest rates – and one of these loans may be yours.

And, if retirement is on your radar, the increased contributions translate to a more substantial retirement payout. Imagine retiring with a bit more in your pocket, ensuring better benefits as you transition into your golden years. It's about securing your future and enjoying the fruits of your labor when the time comes.

Look at a sample computation below to see how the new rates can affect a member’s lump sum and dividends.

“The increase in the Pag-IBIG Monthly Savings Rates shall benefit our members the most because every peso they save will go to their Pag-IBIG Savings. Under our new rates, they will have higher Pag-IBIG Savings that earn annual dividends, which they shall receive upon membership maturity or retirement,” explained Marilene C. Acosta, Pag-IBIG Fund Chief Executive Officer.

“For example, based on our old rates, a member would receive around P87,000 upon reaching membership maturity. On the other hand, a member who saves under our new rates over a period of 20 years would receive P174,000 or double the amount. And, because of their higher savings, they shall also be entitled to higher multi-purpose and calamity loan amounts to help them with their financial needs.”

Think of your Php200 not merely as a contribution but as a strategic move towards your future. This means you can aim for your life goals and buy your own home, while conveniently preparing for a comfortable retirement. Pag-IBIG Fund can help you make smart money decisions and unlock your dreams. Check out these Frequently Asked Questions (FAQs) from the official Pag-IBIG website to get you started.