Make cash loans work for you

We’ve all experienced an urgent need for extra cash at some point in our lives. It could have been to cover tuition fees, sudden emergencies like medical bills, or recuperating after a calamity. Others may use it for financing big purchases like buying a house or starting a small business. A personal loan can be a great option to cover such expenses, but there are still important questions you need to ask yourself before applying for one.

Is getting a loan a good move for my finances?

Borrowing money takes some serious consideration. Your reasons should be practical and reasonable, so you don’t put yourself into unnecessary debts. It can be a wise decision to use it for major life events but not so much if it’s for a luxury item or other extravagant purchases.

Make sure that a personal loan is the most responsible choice. Ask yourself: will I be able to pay it back? If you are on a very tight monthly budget, then you should put off taking a loan until you can afford it.

Yes, I’m ready to take out a loan!

If you are confident your current finances won't suffer because of loan payments, then the next thing you look for is a reliable and trustworthy lender. A lot of Filipinos turn to Pag-IBIG Multi-Purpose Loan (MPL) because of its loan amount, low-interest rates, and quick approval. From January to May 2023 alone, there were nearly one million Pag-IBIG members who were granted cash loans by the agency. Pag-IBIG reported that they have released Php 21.03 billion in cash loans during this period.

The Pag-IBIG Multi-Purpose Loan is a short-term loan program open to any Pag-IBIG member. Qualified members can borrow up to 80% of their total Pag-IBIG Regular Savings. The amount you can borrow will depend on the savings you have contributed. This means the more you have saved in your Pag-IBIG account, the higher the loan amount you can apply for.

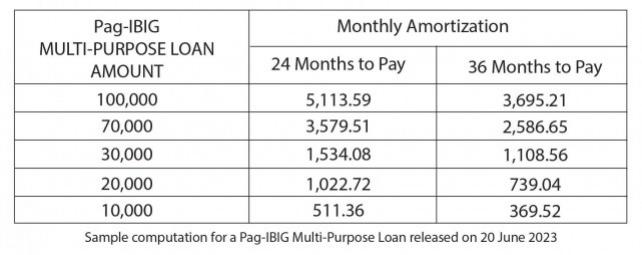

Take a look at the table below for an example of computation for a Pag-IBIG Multi-Purpose Loan. Since being able to pay back a loan is a major consideration, MPL comes at an affordable interest rate of 10.5% per annum. You can choose between three years (36 months) or two years (24 months) for the payment term that will best work for your budget.

It’s also notable in the past years, Pag-IBIG has returned more than 90 percent of its income from its loans to its members in the form of dividends.

Pag-IBIG's Multi-Purpose Loan is also easy to apply for. Members can drop by any Pag-IBIG Fund branch, go online to the Virtual Pag-IBIG page at the Pag-IBIG website, or through the Virtual Pag-IBIG Mobile App. Employed members may also course their loan application through their employers. You may also click this link to apply for the Pag-IBIG Multi-Purpose Loan: https://www.pagibigfundservices.com/virtualpagibig/STLReminder.aspx

So, is getting a loan worth it? Only you as a borrower can correctly assess if it’s the right move. Just remember that a personal loan should be able to help you financially and improve your way of living, instead of becoming a burden if it puts you into an even bigger debt.

More questions? Check out this handy Pag-IBIG FAQ to get answers: https://www.pagibigfund.gov.ph/FAQ_MPL.html.