How to spot scams before they happen

If it’s too good to be true, then it probably is. How many times have we heard this phrase uttered in the wake of scams and their victims? One too many, you might think. As many people struggle through unemployment and uncertainty, sometimes something too good to be true is the only thing that can hold hope. This is exactly the mentality that scammers take advantage of.

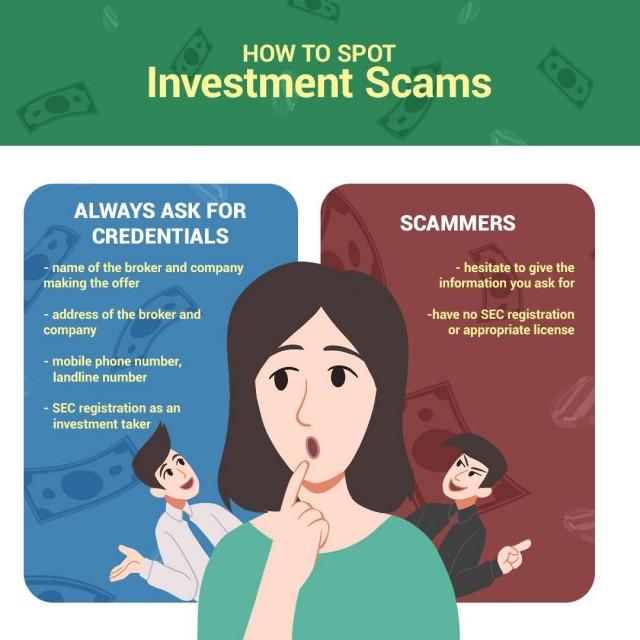

These are tough times, and people want financial security. One of the ways to achieve some financial leverage is to place money in investments. Unfortunately, many scammers count on the vulnerability of people in great need and take advantage of this. Before investing, arm yourself with some ways to determine scams and keep your hard-earned money safe.

Do background checks

When dealing with an individual or a representative of a company, always ask for their full identity. Ask for their office address, mobile numbers, and landline, and their Securities and Exchange Commission (SEC) registration and license. When you do have their contact numbers, call and check all of them if they are working, check the office landlines, or better yet, meet them at their office if possible, just to be doubly sure.

You can also check the SEC website for a list of SEC-registered investment companies to find if the company you are placing with is listed and registered. Do all the necessary checks before giving them your personal information and especially your money.

Ask questions

Scam or not, with every investment scheme, it is essential that we understand the terms that the broker or agent is presenting: how much do you need to place, the rate of returns, how long will it take, fees, penalties, and withdrawal terms, among others.

Scammers are only interested in seeming to take care of you in the now instead of for the long term. They will offer vague and sometimes shady answers that serve to pressure you into giving them your money quickly with the least questions asked.

To protect your money, you must know what you are getting into before you commit. An investment professional will welcome your questions because there will be no confusion in carrying out the transaction. You will be more likely to feel that you are in safe hands, which may lead to more investments in the future.

Do your own research

Scammers will promise you get-rich-quick schemes where the returns are strangely large over a short period. Many will also say that there is no risk, and you will get inside information or hot tips that will bring you an advantage over other investors. They will pressure you to give them the money as soon as possible, even threatening you that the chance will never come again. They will use these statements because investment plans are usually complicated to understand right off the bat.

Ask for documents, financial statements about the fund, or the fund’s prospectus, that give details on the investment you will be making and its conditions, and study it well before saying yes. If it is difficult to understand, find a finance professional or a lawyer who can help you. Know the risks of the fund you are investing in, its performance in the past, and the like. Armed with information, you will know if their 'get-rich-quick' and 'no risk' promises are designed to scam you of your money.

After applying these tips, if you still feel doubtful, simply say ‘no, thank you’ and be on your way.

If you or anyone you know falls victim to an investment scam, it is important to report it immediately to recover your invested money and prevent these scammers from further victimizing others.

Securities and Exchange Commission

Enforcement and Investor Protection Department

E-mail: epd@sec.gov.ph

Landline: (02) 8818-6337

National Bureau of Investigation

NBI Anti-Fraud Division

E-mail: afad@nbi.gov.ph

Landline: (02) 8525-4093

Philippine National Police

Anti-Cybercrime Group (ACG)

Website: www.pnpacg.ph

Email: acg@pnp.gov.ph

Landline: (02) 8723-0401

Invest in legitimate opportunities

In line with advocating the safety of the general public’s personal finances and prevent investors from falling prey to fraudulent investment schemes, the government strongly encourages investments into legitimate opportunities, such as government bonds.

These bonds are considered one of the safest and most secure forms of investments since they guarantee return, project the capital, and contribute to the funding of projects that would benefit the Filipino people.

The government also seeks to pass reforms that would make it easier for Filipinos to invest in legitimate opportunities. The Duterte administration's proposed Passive Income and Financial Intermediaries Taxation Act (PIFITA) aims to ease the tax regime for bonds and stocks by lessening the number of taxes on financial transactions from 80 to 36. If passed, PIFITA would simplify entry into safe and secure investment opportunities for Filipinos looking to gain more income.