The estate tax amnesty

Republic Act 11213, signed into law by President Rodrigo Duterte last month, granted amnesty for delinquent estate taxes.

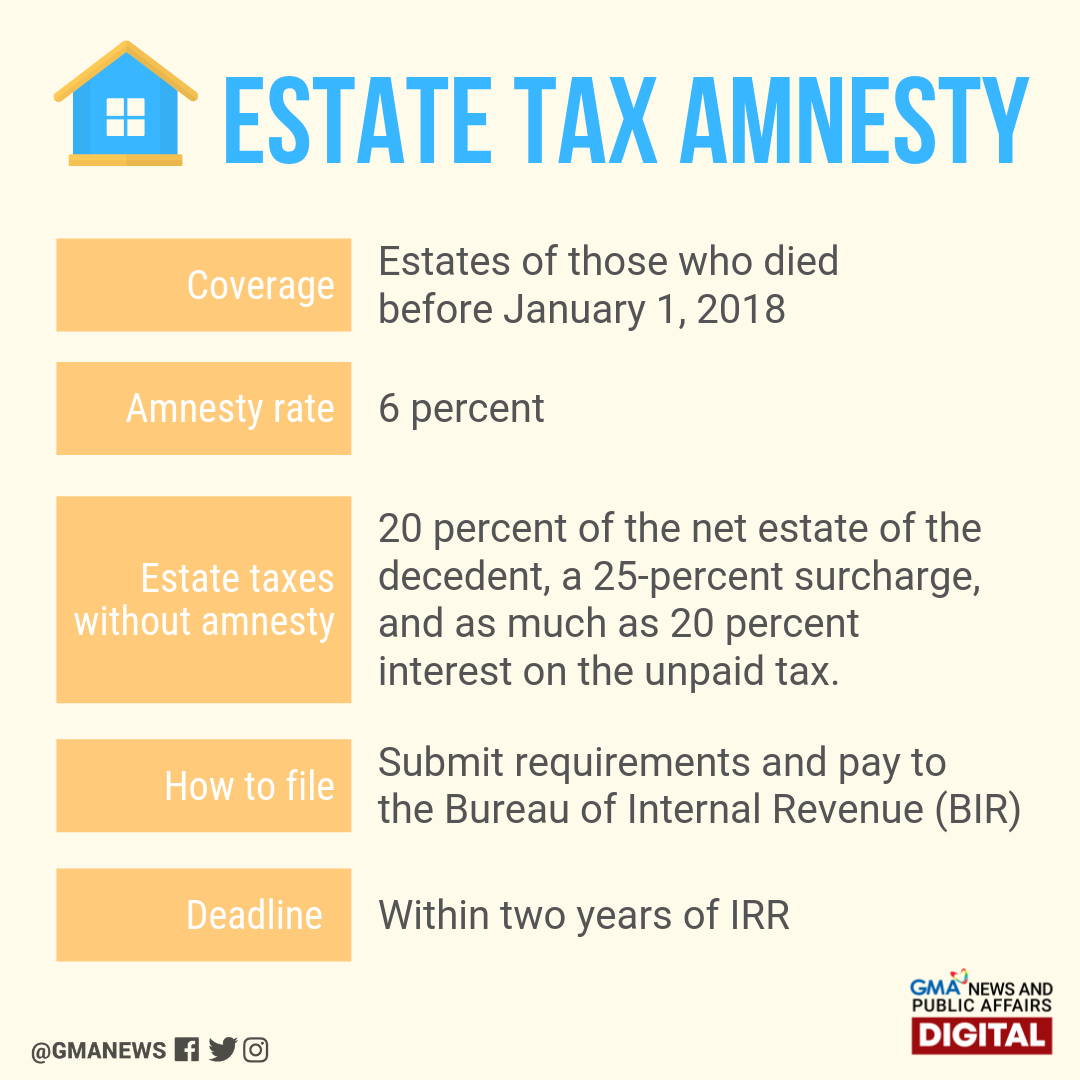

Under this new law, the government will collect only 6 percent of the estate of all those who died before January 1, 2018. The estate's value will be equivalent to its value at the time of the person's death.

Prior to this, taxpayers would have had to pay 20 percent of the net estate of the decedent, a 25-percent surcharge, and as much as 20 percent interest on the unpaid tax.

The measure was signed into law on February 14, 2019, and will be in effect for two years once its implementing rules and regulations (IRR) are finalized.

Under the approved version, however, President Rodrigo Duterte vetoed the one-time settlement of estates for properties which are subject to multiple unsettled estates.

This means that if three generations fail to pay estate taxes, each of the generations will have to pay the estate tax amnesty rate of 6 percent.

Previous proposals allowed a one-time settlement of the estate tax, which would have mandated only one generation to settle the estate.

Those who may avail of the amnesty are legal heirs, transferees or beneficiaries, or the authorized executor or administrator of the estate of a person who died before January 1, 2018.

The implementing rules and regulations (IRR) of the measure has yet to be finalized and is currently being drafted. — BM, GMA News