Filtered By: Money

Money

PHL inflation inching up, but Bangko Sentral to hold fire in 2013, say economists

By Siegfrid O. Alegado

Philippine inflation is seen to pick up in July on higher food prices and the peso's weakness stoking costs of imported goods like petroleum, according to economists polled by GMA News Online.

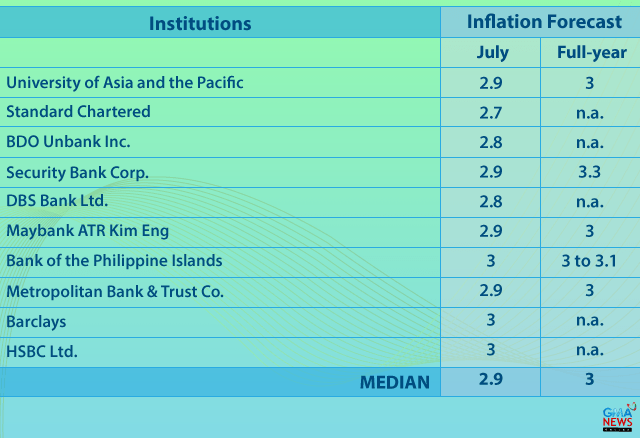

A GMA News Online poll of 10 economists and analysts yielded a median inflation forecast of 2.9 percent for July, within the Bangko Sentral ng Pilipinas's 2.2 to 3.1 percent projection for the month but slightly faster than the 2.8 percent recorded in June.

July inflation figures are slated for release Tuesday, July 6.

“Recent uptick in rice prices and continued weak Peso will likely keep CPI marginally elevated from June,” Patrick Ella, Security Bank Corp.'s economist, said.

The Agriculture department has said that prices of milled rice are bound to increase during the lean season—July to August—and likely to be felt by consumers only in urban areas.

The Agriculture department has said that prices of milled rice are bound to increase during the lean season—July to August—and likely to be felt by consumers only in urban areas. Meanwhile, the peso traded at the 43 to-a-dollar level for the whole of July, weaker than the 40 to 41 territory it moved at for most of the year.

The peso's relative weakness coupled with turmoil in the oil-rich Middle East and North Africa fueled the rise in retail pump prices, said Bank of the Philippine Islands economist Nicholas Antonio Mapa.

For the rest of the year, economists and analysts expect inflation continuing its uptrend as risks posed money growth and peso weakness finds its way to the real economy.

“A gradual pass-through of the recent peso weakness, coupled with a fast acceleration of money supply, should add to inflationary pressures,” said Trinh Nguyen, Hong Kong-based economist at HSBC Ltd.

Metropolitan Bank & Trust Co. research head Ildemarc Bautista pointed out that effects of the peso's weakness to inflation will be most felt in the third quarter, touted as the Philippines' import season.

Growth in money supply, meanwhile, was at 20.3 percent in the first half of the year, a multi-year high.

“Flushing the financial system with liquidity creates an environment conducive for credit growth which is positive for economic growth but also presents the specter of rising inflation,” said Singapore-based economist at DBS Bank Ltd. Eugene Leow.

Despite the uptrend, the median 2013 inflation forecast still points to the lower end of the Bangko Sentral's 3 to 5 percent target, GMA News Online's poll showed.

The benign inflation imprint prompted all polled analysts like Jeff Ng, Singapore-based economist at Standard Chartered, to expect monetary authorities “to maintain its policy rates (overnight borrowing and SDA) for the rest of 2013.”

Last July 25, the policy-setting Monetary Board left policy rates—the benchmark for bank loans—untouched at record lows of 3.5 percent for overnight lending and 5.5 percent for overnight borrowing.

They also kept settings of special deposit accounts (SDA)—a tool to mop up excess liquidity—unchanged.

The Monetary Board has slashed the rate on SDAs three times earlier this year to 2 percent, and told bankers to gradually unwind investment management activities (IMA), a type of account in banks’ trust arms, from the facility starting July in line with a total ban by 2014.

The moves were done to flush funds into more productive uses for the economy. — OMG, GMA News

Tags: philippineeconomy, inflation

More Videos

Most Popular