BIR: Sale, use of fake PWD IDs is tax evasion; revenue losses at P88.2B

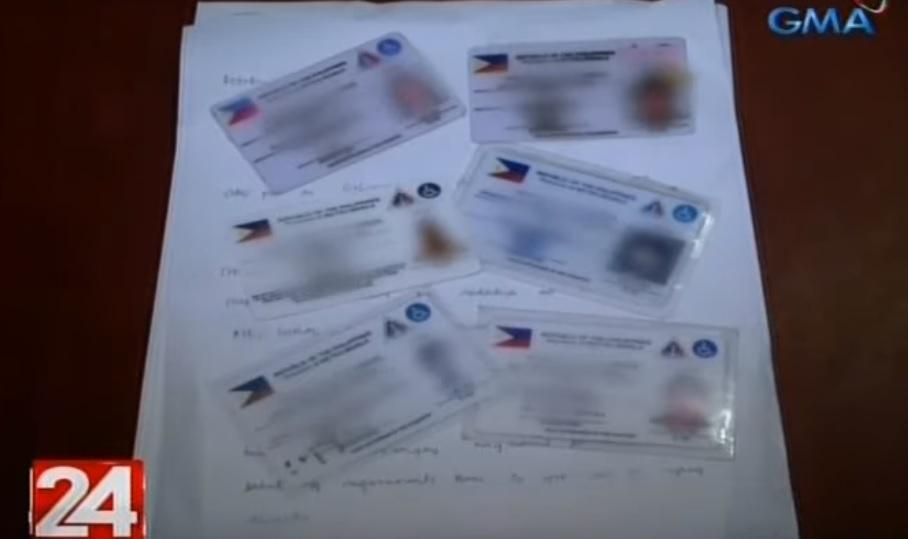

The Bureau of Internal Revenue (BIR) on Thursday issued a warning against the sale and use of counterfeit Person with Disability (PWD) identification cards as such acts would be tantamount to tax evasion.

In a statement, BIR Commissioner Romeo Lumagui Jr. said he has ordered the taxman’s officials to coordinate with other government agencies to combat the proliferation of fake PWD IDs.

The BIR chief said, citing a recent Senate probe, the “tax evasion scheme” had resulted in an estimated revenue loss of P88.2 billion in 2023 alone for the government.

"People who sell and use fake PWD IDs are not only committing tax evasion, they are also disrespecting legitimate and compliant PWDs. The discount given by law to PWDs is for the improvement of their well-being and easing of their financial burden,” Lumagui said.

“It is not some common discount card that is accessible to the general public. Expect the BIR to run after fake PWD ID sellers and users," the taxman chief said.

The 1987 Constitution of the Philippines provides the rights and needs of PWDs.

Consistent with this constitutional provision, Republic Act (R.A.) No. 7277, as amended by R.A. No. 10754, was enacted to provide PWDs the opportunity to participate in mainstream society by offering benefits upon the presentation of a PWD ID.

These benefits include a 20% discount and an exemption from Value-Added Tax (VAT) on certain goods and services for their exclusive use and enjoyment.

Unfortunately, Lumagui said that unscrupulous individuals have exploited the system by selling fake PWD IDs to those fraudulently seeking to claim the mandated benefits.

These fake IDs are not only sold on the streets but also through online marketplaces, making them easily accessible, according to the BIR chief.

On December 5, 2024, the Senate Committee on Ways and Means conducted a public hearing on Senate Resolution No. 1239 regarding the use of fake PWD IDs.

The hearing highlighted the adverse effects on businesses and the government due to the proliferation and misuse of fake PWD IDs.

The Senate Resolution aims to find solutions to stop the sale of such fake IDs and prevent those without disabilities from taking advantage of benefits intended only for PWDs.

Lumagui said the BIR will continue to conduct tax audits on transactions involving PWDs reported by establishments.

As required under the regulations, establishments must provide records of sales to PWDs, including the name of the PWD, ID number, disability, and the amount of discount and VAT exemption given.

The BIR will then verify the legitimacy of the IDs submitted by establishments.

If the BIR finds that such PWD ID numbers are not legitimate, it will disallow the deductions claimed by the establishments, according to Lumagui.

Additionally, VAT-exempt sales linked to fake IDs will be assessed with deficiency VAT, including penalties and interest, the BIR chief said.

The tax collection bureau will intensify its coordination with relevant government agencies, including the Department of Health and the National Council on Disability Affairs, to verify the legitimacy of PWD ID, said the BIR head. —RF, GMA Integrated News