NCR office space rental prices seen to drop as vacancy levels increase — JLL

Commercial real estate and investment management firm JLL expects office rental prices in Metro Manila to average slightly lower in 2024, with more space set to be available even as vacancy levels are already currently at double digits.

In a press briefing in Makati City, JLL head of research Jan-Loven De Los Reyes said office rental prices are expected to average P1,000 per square meter this year, down from the P1,005 per square meter recorded in end-2023.

Rental prices were recorded at P1,004 per square meter in the first quarter of the year, which reflected a 0.2% decline from the previous quarter, and a 3.4% drop from the P1,039 per square meter in the first quarter of 2023.

Prior to the pandemic, rental rates were reported to have ranged between P1,100 to P1,200 per square meter.

De Los Reyes said the lower prices come as some 500,000 square meters of space are set to be available this year, bringing the projected vacancy level to average 22% this year, even higher than the 19.9% recorded in the first quarter.

“By end-2024, our forecast for vacancy levels is to range around 22%, and the reason for that is we expect an additional 500,000 square meters of office lot coming in that will apply supply pressure on the market, considering that we have elevated vacancy levels,” De Los Reyes said.

Broken down geographically, Parañaque City had the biggest vacancy rate of 50.4%, followed by Manila City with 38.1%, Muntinlupa City with 28.3%, Pasay City with 24.1%, Quezon City with 20.9%, Makati City with 18.0%, Pasig City with 16.8%, and Taguig City with 15.0%.

Central business districts (CBD) had lower office space vacancy rates, with the Ortigas CBD recording 17.9%, the Makati CBD with 15.4%, and Bonifacio Global City with 9.1%.

Aside from the increase in supply, De Los Reyes said firms have started to downsize their spaces in line with flexible and work-from-home arrangements, leading to less space requirements.

JLL data showed that there were 97,365-square-meters worth of office space move outs in the first quarter of the year, with a BPO firm in Muntinlupa pulling out of a 3,400-square-meter space.

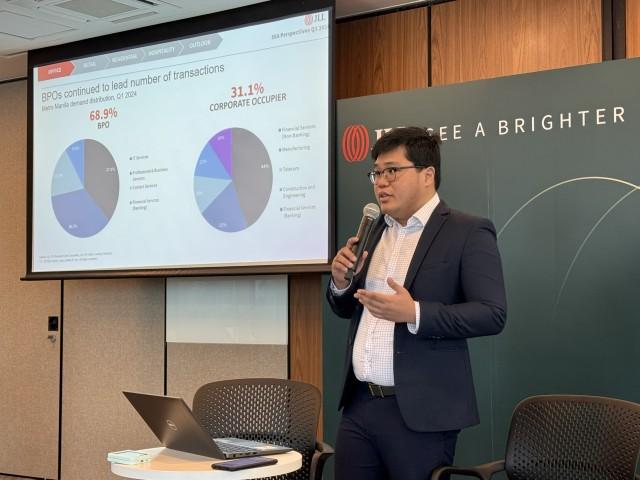

The BPO sector in general, however, continued to lead the number of transactions for the quarter as it accounted for 68.9% of demand in the first quarter, composed of information technology (IT) services with 37.3%, professional and business services with 36.2%, contact services with 17.2%, and financial services with 9.3%.

“The BPO (business process outsourcing) market will continue carrying the sector in the next couple of quarters including the near and medium-term forecast,” De Los Reyes said.

Corporate occupiers accounted for the remaining 31.1%, comprised by financial services with 44%, manufacturing with 21%, telecoms with 13%, construction and engineering with 12%, and financial services with 10%.—AOL, GMA Integrated News