BIR eyes to collect 1% withholding tax from online merchants by Q4

The Bureau of Internal Revenue (BIR) is targeting to collect a creditable withholding tax of 1% from the partner-merchants of online platforms by the fourth quarter of 2023.

Early this year, the BIR proposed to impose a creditable withholding tax of 1% on one-half of the gross remittances of online platform providers to their partner sellers or merchants.

The taxman had defended the proposal saying it is not a new tax and its collection is within existing laws.

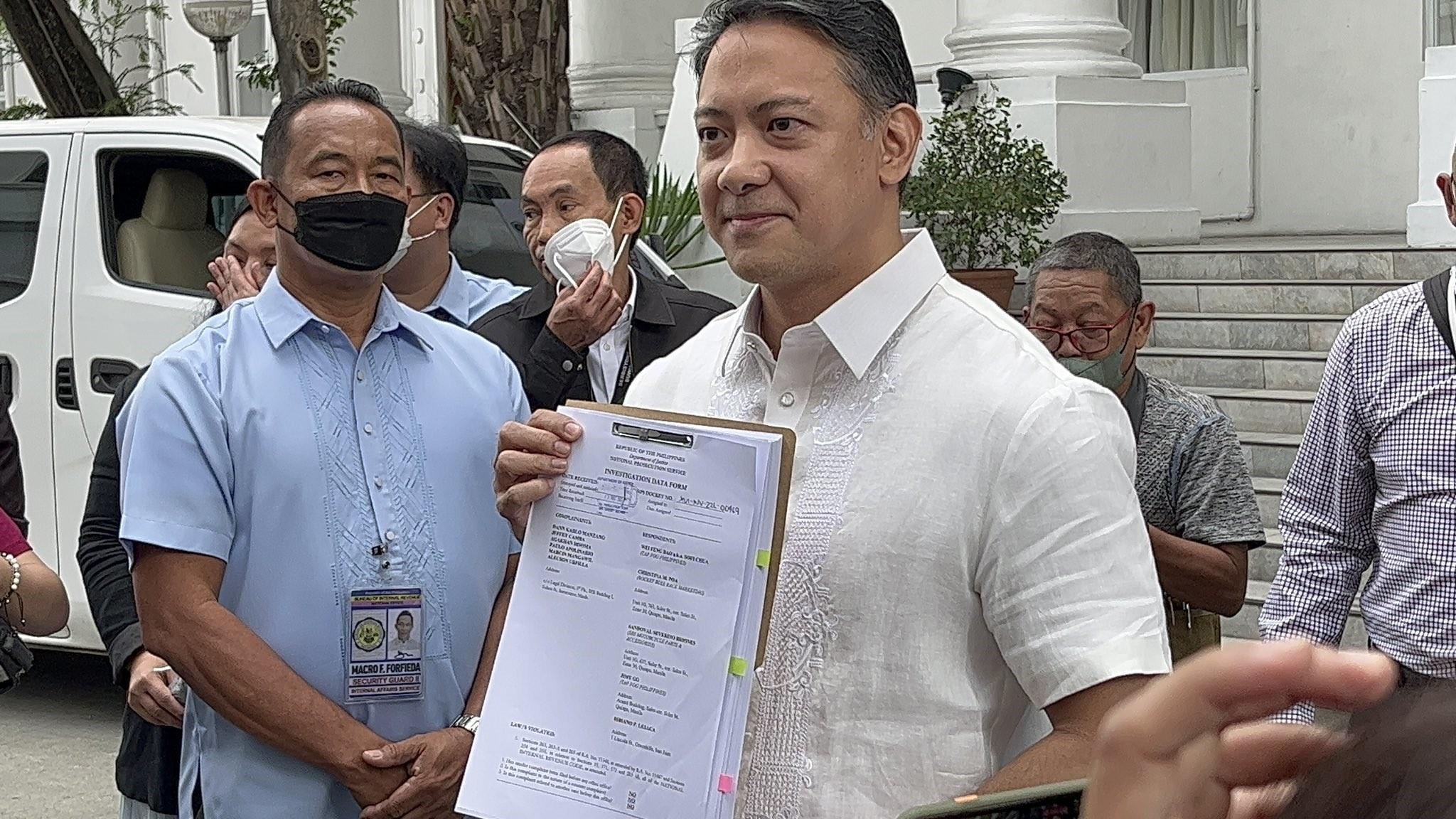

“The proposal is a creditable withholding tax. So it’s not really a new tax. It’s just a mode of collecting,” BIR Commissioner Romeo Lumagui Jr. said in May.

During a chance interview on Thursday, Lumagui told reporters: “We may start in the fourth quarter… We are aiming for this year, so it would be a full implementation next year.”

The withholding tax is the amount withheld by a business in payments of goods or services which is directly remitted to the government on behalf of suppliers or employees.

Lumagui said discussions with concerned stakeholders are ongoing as he said all inputs are being considered.

“All private sectors are onboard so they'll understand,” he said.

The BIR had argued that with the proliferation of online sales transactions through the facilities of online platform providers, there is a need to take advantage of the opportunity to identify sellers of goods and services who are therefore obliged to declare their income resulting from these transactions for tax purposes.

Lumagui reiterated the taxman’s stance, saying that imposing tax on online merchants is aimed to level the playing field between traditional brick and mortar retailers and those selling on digital platforms or marketplaces.

The BIR chief said that collecting withholding tax from those selling on online platforms is similar to how malls collect it from their tenants.

“Malls require [tax] registration of their lessees, so in the same, why can’t we regulate platforms? They should require everyone conducting business with them to register,” Lumagui said.

The United Filipino Consumers and Commuters (UFCC) earlier urged the BIR to reconsider its plan, describing it as a “heavy blow” to “ordinary Filipino people who will suffer the effects of the new tax."

“At a time when the country has yet to recover from the crippling effects of the COVID-19 pandemic fully, introducing new taxes that will ultimately hurt the poor is the last thing the country needs right now. Naghihirap ang taumbayan, huwag na sanang dagdagan pa ng pamahalaan (Filipinos are already experiencing hardships, I hope the government will not add to their burdens.),” UFCC President RJ Javellana said in May.

“We are concerned that the plan to have the new 1% withholding tax will be the beginning of more taxes to be imposed upon the already suffering public. It has already been reported that the Department of Finance (DOF) plans to introduce new and higher taxes in 2024,” he added.

The group also called on online selling and services platform providers to be the voice of their partner sellers and merchants in their representation to the BIR. — RSJ, GMA Integrated News