Freeze on 2nd tranche not enough: Makabayan solons want 1st tranche of fuel excise tax scrapped

While it is a welcome development, the suspension of the second tranche of excise taxes on fuel products in 2019 will not ease the burden on poor Filipinos affected by price increases, progressive lawmakers from the House of Representatives said.

In a statement on Tuesday, Anakpawis party-list Representative Ariel Casilao labelled the development as "misleading," as it neglects the negative socio-economic impact of the first tranche of excise tax implemented in January this year under the Tax Reform for Acceleration and Inclusion (TRAIN) Law on the poor sectors.

“What the poor is demanding is the scrapping of regressive provisions of the TRAIN law, especially the excise tax on oil products, triggering skyrocketing of prices especially food items,” Casilao said.

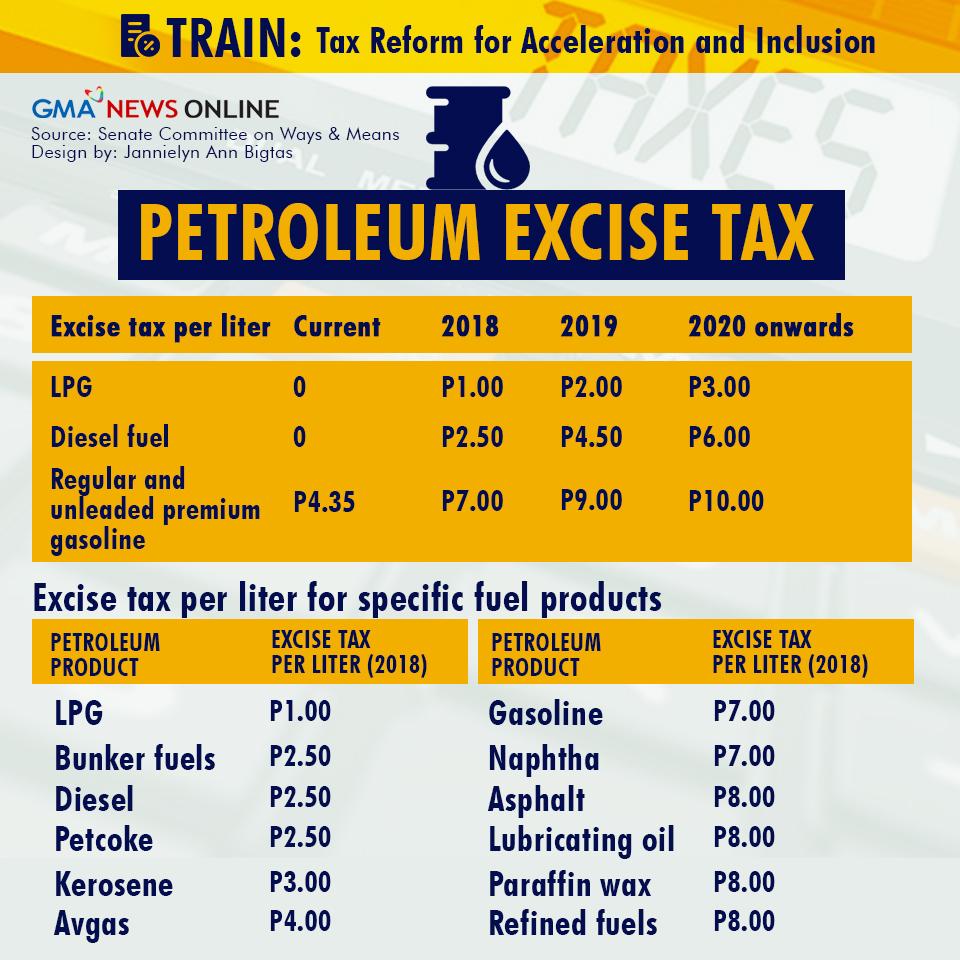

What was suspended was increasing the excise tax per liter of diesel and gasoline to P4.50 and P9, respectively, in January 2019.

The earlier imposition of a P2.50 excise tax per liter of diesel and P7 per liter of gasoline remains.

Casilao said that in 2010, about 1.3 billion liters of diesel were used for transport while another 1.1 billion liters were used for machinery and equipment.

The imposition of the excise tax would therefore add about P6 billion to production costs, he said.

“The added costs in production are obviously passed on [to] the consumers via surged levels of prices. It is elementary that we are facing unabated inflation rate hikes—meaning, the root of the crisis was the first tranche of the TRAIN law imposition of excise tax, not the forthcoming second tranche next year,” Casilao added.

For the lawmaker, the suspension of the second tranche of excise taxes on fuel products next year is already an admission on the part of the administration of the detrimental effects of the TRAIN Law.

Bill seeks to reverse TRAIN

ACT Teachers party-list Representative Antonio Tinio stressed the need for "immediate and concrete solutions" to the "never-ending" price increases.

"We in the Makabayan bloc have already filed House Bill 7653, which seeks to reverse the regressive and anti-poor taxation from TRAIN 1 [and repeal] certain sections of the said law. We urge the House leadership to immediately hear and pass House Bill 7653. The removal of the excise tax provision should be one of the immediate concrete solutions to the economic crisis," he said.

Tinio's fellow ACT Teachers party-list Representative France Castro said that suspending the second tranche only delays its implementation and would not relieve Filipinos of the burden of high fuel prices.

"Wages of the people have remained low while prices of all basic commodities continue to hike and social services provided by government remain inaccessible to the poorest families. The ordinary Filipino family have close to nothing to spend for their daily needs," Castro said.

"It is about time that the Duterte administration remove additional excise taxes on fuel which would immediately help the poor Filipino families," she added. — BM, GMA News