A tough year for the peso

It was a rough ride for the Philippine peso as the foreign exchange market wobbled through the volatility caused by global and domestic events.

The US dollar maintained its strength against most currencies as prospects of an interest rate lift off in the world's largest economy favored dollar assets.

The May elections, the Brexit vote or Britain's withdrawal from the European Union, the victory of Donald Trump as the next US president contributed to the volatility that rocked the peso-dollar market.

What roiled investor sentiment through most of the year though – bets that the Federal Reserve will finally raise interest rates as the US economic recovery gains traction – finally happened this month.

The Federal Reserve decided in its last policy meeting of 2016 to raise interest rates by 25 basis points and signaled more increases next year until the initial target of 1.25 percent is reached.

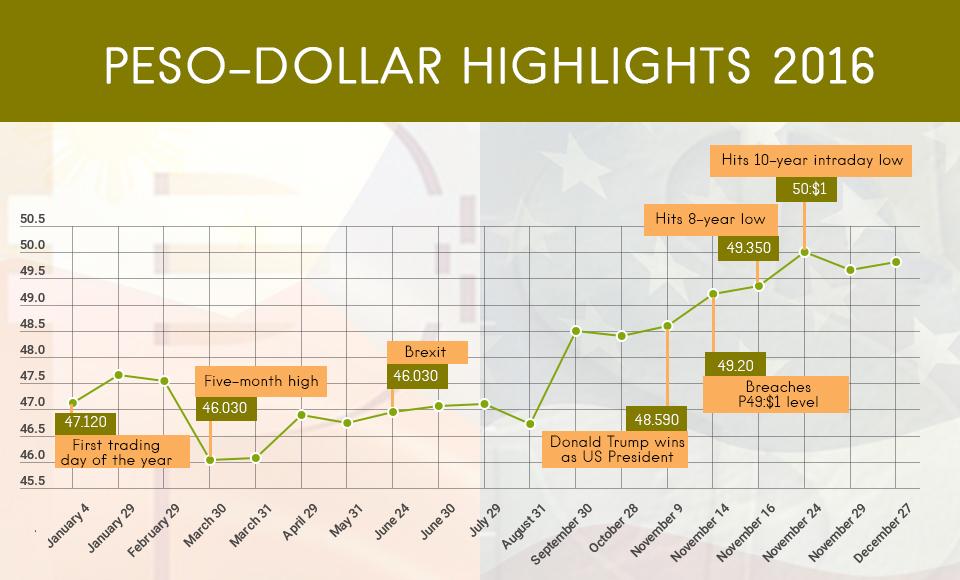

But earlier in November the peso started trading at eight-year lows against the greenback, and tested intraday the P50:$1 mark – a level unseen in 10 years.

The peso-dollar exchange rate opened the year at P47.12:$1 on January 4, and has reached its strongest at P46.030:$41 on March 30, but eventually caved in as Fed rate hike jitters clobbered the market.

President Rodrigo Duterte's campaign against illegal drugs and his anti-US, anti-EU, anti-UN stance were considered as side issues that elicited further market volatility. — VS, GMA News