Want lower income tax? Be ready for higher prices

So, you probably heard (or read) the government plans to lower the personal income tax rates and perfectly understand what this means for dutiful taxpayers such as yourself. Or do you?

Don’t party just yet because there’s a flip side that you should know about.

Indeed, the Department of Finance submitted to Congress last September a proposal to adjust the taxable income brackets and lower the personal income tax rates. This will give taxpayers more take-home pay, but at the same time burn a gaping P159-billion hole in the government’s coffers in terms of foregone revenue.

That is why the DOF paired its proposal to reduce the income tax with a set of measures that will offset or even exceed the projected losses. These measures include removing various value-added tax (VAT) exemptions and raising excise taxes on certain goods.

Affected by lifting the VAT exemptions are specific sectors such as senior citizens and persons with disabilities, and specific organizations like the Boy Scouts and the Girl Scouts of the Philippines. Removing the exemptions from such groups and sectors will not necessarily impact those who do not belong to them.

The DOF proposal will also hit some items used in the goods and services consumed by many Filipinos.

For example, removing the VAT exemption on the National Grid Corporation of the Philippines may lead to higher electric bills down the line.

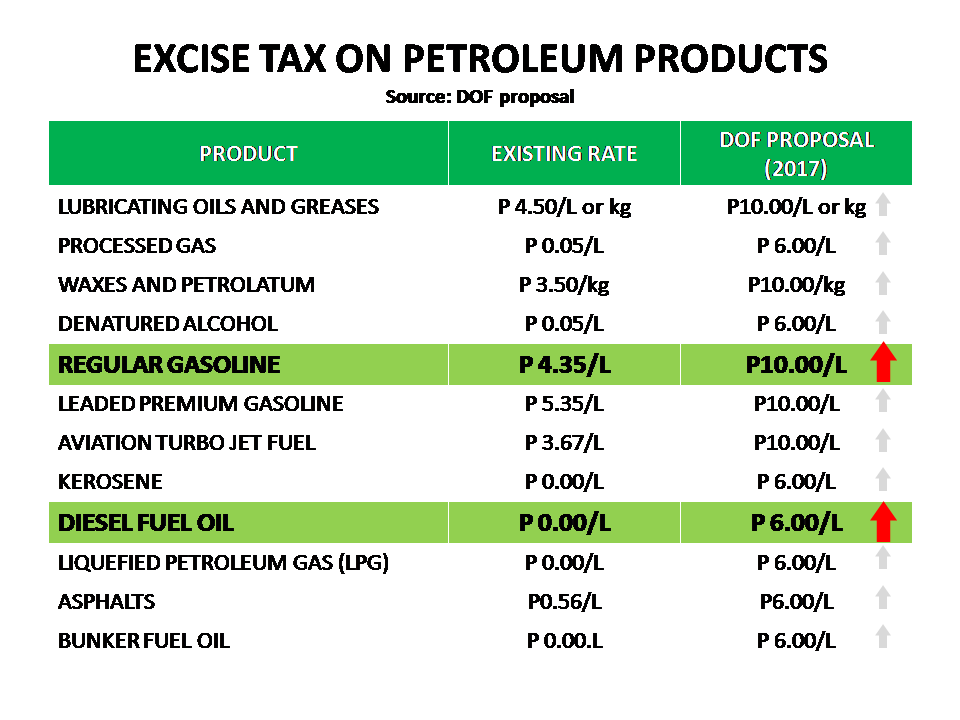

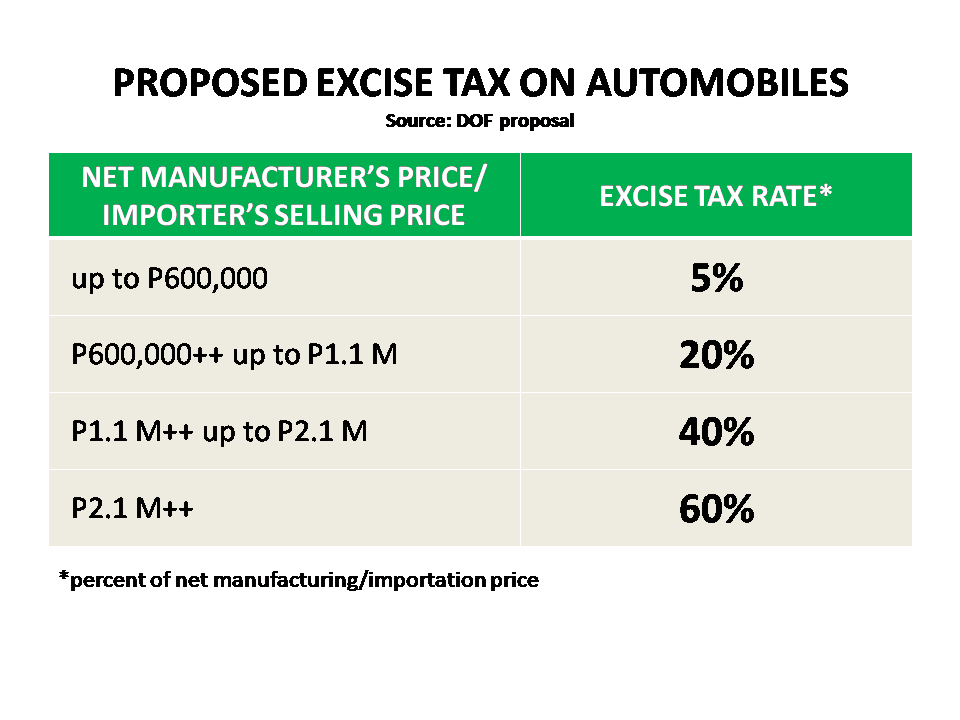

Motorists, commuters, and prospective car buyers will likely hurt from the planned increase in excise taxes on petroleum products and automobiles.

The excise tax on regular gasoline will be raised to P10 per liter from P4.35 per liter. A P6 per liter excise tax will also be imposed on diesel, which presently does not have a corresponding rate.

The DOF further proposes to increase the tax rates on petroleum products “by 10 percent every year hereafter effective on January 1, 2018, through revenue regulations issued by the Secretary of Finance.”

Based on the DOF proposal, vehicle prices will likely go up in light of the proposed excise tax rates on automobiles ranging from 5 percent to as much as 60 percent of the net manufacturing price or importation price.

Playing down the impact

Since electricity and petroleum products will be affected by the offsetting tax measures, the question boils down to when and not so much how it would bring a corresponding increase in prices of goods and services.

The DOF is playing down the impact on prices, saying the increase would be minimal. When it comes to petroleum products, for instance, the official projection indicates the price increase would be nowhere near the levels when world crude prices surged during 2009 to 2013. Back then, crude oil prices spiked from $40 to as much as $130 per barrel, a 225 percent increase.

University of the Philippines economics professor Renato Reside Jr. agrees with the DOF line on the impact of the offsetting tax measures on prices. “There might be an initial bump up in prices, but in terms of spiralling inflation – that will not happen,” he said.

Sonny Africa, executive director of non-government think tank Ibon Foundation, takes a more guarded stance. “An additional expense of even just one peso or ten pesos will already be a heavy burden for a poor Filipino family,” he said in an interview with GMA News.

Anticipating the inflationary pressure from the proposed offsetting tax measures, the government is readying subsidies for the poor to cushion the impact of price hikes.

DOF Assistant Secretary Paola Alvarez told GMA News the Finance Department is coordinating with other concerned departments to work out the implementation of mitigating measures such as higher conditional cash transfers and “tawid-pamasada” (fuel subsidies). “We call it direct or more targeted subsidies so that the lower sectors who need it the most will be the ones to receive it,” she said.

Whether or not the subsidies will be enough to mitigate the impact of removing the VAT exemptions amid raising excise taxes increases remains to be seen. What seems clear at this point is that taxpayers are bound to raise a howl.

Increasing taxes is never popular, and no one wants higher taxes, Alvarez conceded. “But what we need to understand is that we need to make a little sacrifice so we can afford the infrastructure, the hospitals, the public school education. Our long-term goal is to reduce the poverty rate by 17 percent,” she said. — with reports from Lei Alviz/KG/VDS, GMA News