Filtered By: Money

Money

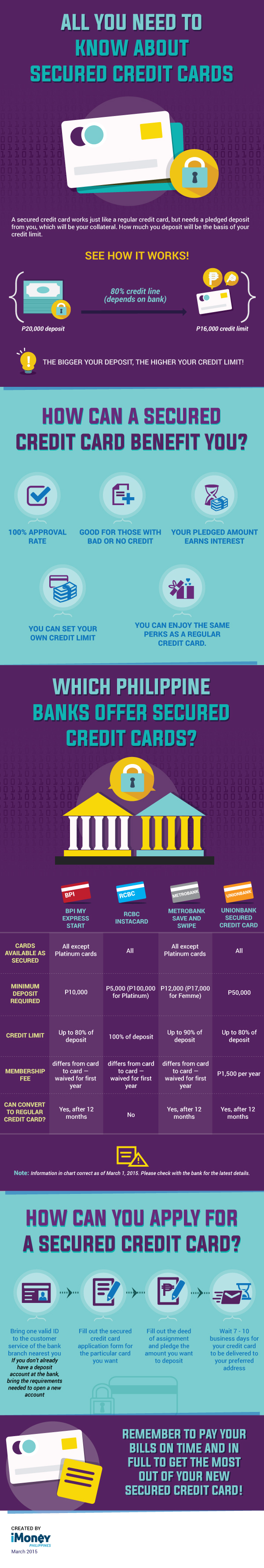

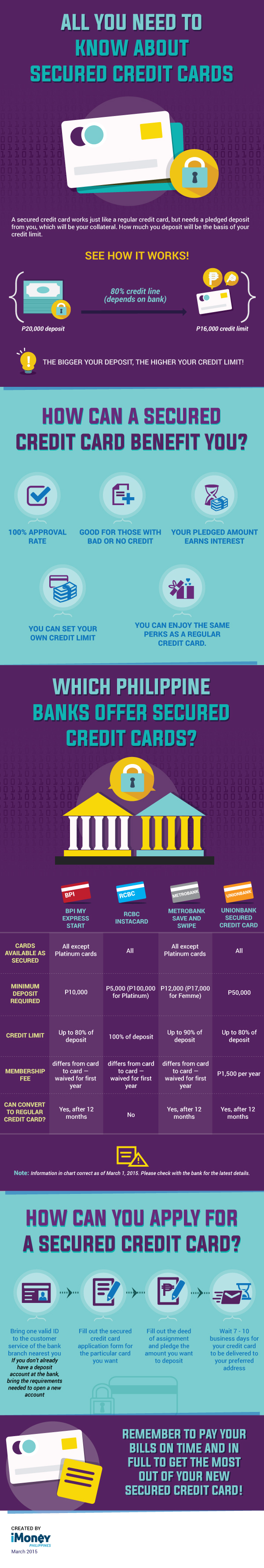

Infographic: How to get a 'secured credit card'

Getting a credit card can be difficult. You need to collect a lot of documents, be regularly employed, and pass a stringent credit check. If your creditworthiness is less than stellar, the credit card company will probably reject your application.

So if you have no credit history to speak of, or a bad one, how are you supposed to apply for a credit card?

Sounds familiar?

Don't despair. There’s a product that can help you get the credit card you want – regardless of your credit history. You don’t need to submit income documents or fulfill the stringent requirements of credit card companies.

All you need is to have or open a deposit account in a bank and you’ll get a credit card.

The product?

Secured credit cards.

A secured credit card works the same as a regular credit card, with your deposit serving as collateral. If you use your credit card in a responsible manner, paying your monthly bills on time and in full if possible, you can build a good credit history which will allow you to apply for a regular credit card in 12 months.

But if you fail to pay back your credit card bill, the bank will take your deposit.

Interested? Read our infographic to find out more, and how to apply for a secured credit card.

Find the credit card you want with our tool, and check with the bank to see if you can get it as a secured credit card!

How To Get A Secured Credit Card In The Philippines first appeared on iMoney.ph.

How To Get A Secured Credit Card In The Philippines first appeared on iMoney.ph.

More Videos

Most Popular