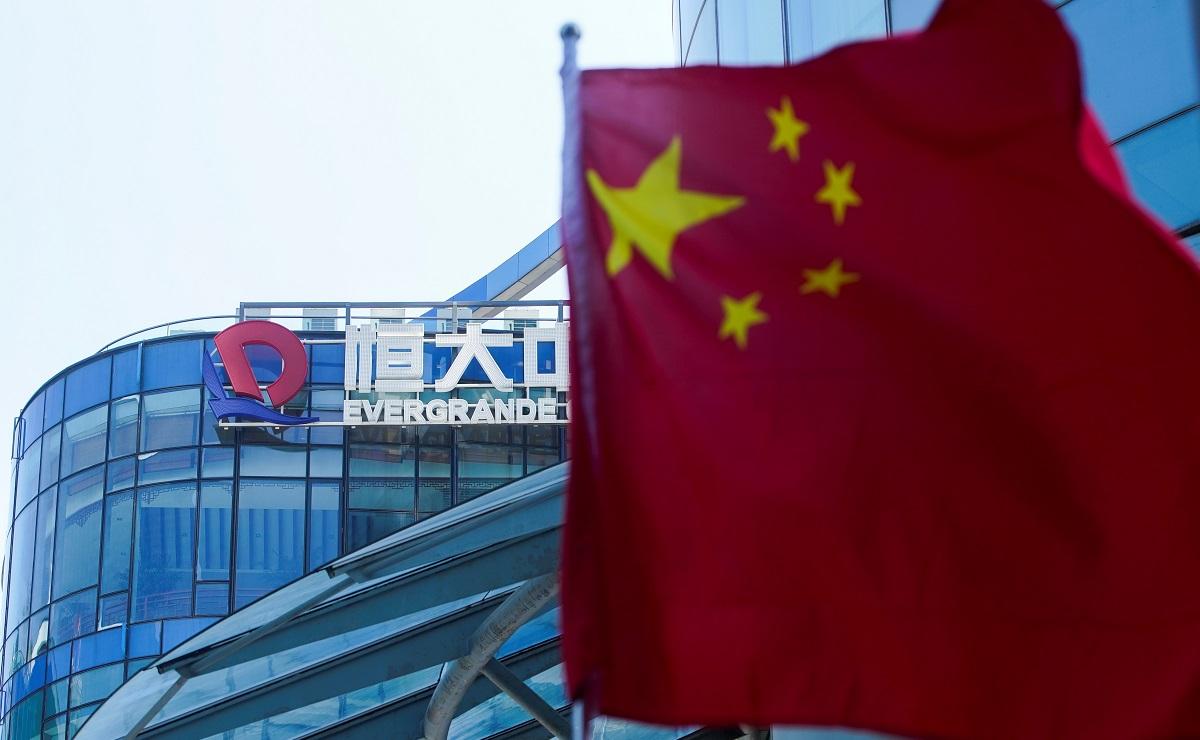

China’s Evergrande teeters on edge of default as $148-M payment falls due

SHANGHAI/HONG KONG — Some bondholders of cash-strapped China Evergrande Group have not received coupon payments by the end of 30-day grace periods at close of Asia business on Wednesday, sources said, pushing the developer again to the edge of default.

Evergrande, the world's most indebted developer, has been stumbling from deadline to deadline in recent weeks as it grapples with more than $300 billion in liabilities, $19 billion of which are international market bonds.

The company has not defaulted on any of its offshore debt obligations. But a 30-day grace period on coupon payments of more than $148 million on its April 2022, 2023 and 2024 bonds ends on Wednesday.

A failure to pay would result in a formal default by the company, and trigger cross-default provisions for other Evergrande dollar bonds, exacerbating a debt crisis looming over the world's second-largest economy.

Exactly what time the grace period expires on Wednesday is unclear, but the two sources with knowledge of the matter said some bondholders had not been paid by the end of the Asian business day. They declined to be named as they were not authorized to speak to the media.

Evergrande declined to comment.

For its two separate offshore coupon payment obligations that were due in late September, the developer's bondholders did not receive the payments until one working day after the 30-day grace periods ended.

Evergrande's problems add to concerns about a liquidity squeeze in the property sector. It also has coupon payments totaling more than $255 million on its June 2023 and 2025 bonds due on Dec. 28.

China's property woes rattled global markets in September and October. There was a brief lull in mid-October after Beijing tried to reassure markets the crisis would not be allowed to spiral out of control.

But concerns have resurfaced, with the US Federal Reserve warning on Tuesday that China's troubled property sector could pose global risks.

More developers are seeing their credit ratings slashed on their worsening financial profiles.

Moody's Investors Service on Wednesday downgraded Kaisa Group, which on Tuesday made a desperate plea for help, citing liquidity risks, limited financial flexibility, and weak recovery prospects for its creditors.

Kaisa has the most offshore debt of any Chinese developer, after Evergrande. The developer has coupon payments of more than $59 million due on Thursday and Friday.

S&P Global Ratings said separately it had downgraded Shimao Group Holdings' rating to "BB+" from "BBB-" over concerns that tough business conditions would hinder the company's efforts to reduce debts.

S&P considers a rating under "BBB-" to be speculative grade.

Worries over the potential fallout from Evergrande have also slammed the bonds of Chinese real estate companies amid worries the crisis could spread to other markets and sectors.

Shares of developer Fantasia Holdings plunged 50% on Wednesday after it said there was no guarantee it would be able to meet its other financial obligations following a missed payment of $205.7 million that was due on Oct. 4.

Financing options

Underlining the liquidity squeeze, some real estate firms disclosed plans to issue debt in the inter-bank market at a meeting with China's inter-bank bond market regulator, the Securities Times reported on Wednesday.

In the near future, real estate companies will issue bonds in the open market for financing, while banks and other institutional investors will assist via bond investment, said the paper.

Some Chinese state-owned companies have told regulators to consider adjusting lending restrictions to property developers for borrowing related to mergers and acquisitions, Chinese media outlet Cailianshe said on Wednesday.

The companies said that if they took on new debt in the process of acquisitions, they might breach financial requirements introduced by the central bank last year that developers must meet to get new bank loans.

Debt-laden developers including Evergrande and peer Kaisa have also been looking to raise cash to repay their many creditors by selling some of their property and other business assets.

Beijing has been prodding government-owned firms and state-backed property developers to purchase some of Evergrande's assets to try to control the fall.

Rising concerns about the developers' woes spreading to other sectors was visible on Wednesday as the spread, or risk premium, between lower risk, investment grade Chinese firms and US Treasuries widened to a more than five-month high.

Once China's top-selling property developer, Evergrande narrowly averted catastrophic defaults twice last month by paying interest for its offshore bonds just before the expiration of their grace periods.

Despite the company's debt problems, its electric vehicles (EV) unit is pushing ahead with its business plan. The unit is seeking Chinese regulatory approval to sell its inaugural Hengchi 5 sport-utility vehicles.

Shares in Evergrande ended up 3% on Wednesday, while stock in the EV unit closed the day 0.8% higher after having risen more than 2% earlier.

Founded in Guangzhou in 1996, Evergrande epitomized a freewheeling era of borrowing and building. But that business model has been scuttled by hundreds of new rules designed to curb developers' debt frenzy and promote affordable housing. — Reuters