What you should know about WESM and the Meralco rate hike

Thirteen years ago, the Electric Power Industry Reform Act (EPIRA) was signed into law with the goal of bringing down electricity rates and improving supply through greater competition and efficiency.

Instead, consumers faced the prospect of a record power hike when the Manila Electric Co. (Meralco) sought a P4.15/kWh increase last December, with critics accusing the distributor of collusion with energy suppliers to rake in profits.

The Supreme Court issued a temporary restraining order on the rate hike, and has scheduled oral arguments on four petitions against it on Tuesday.

The labor coalition Nagkaisa has said fraud became the norm in the power industry instead of service to consumers, as shown by rising prices and energy cartels.

Meanwhile, the Freedom from Debt Coalition said the move to increase power rates is “a cruel example of corporate greed in a time of disaster” and the “bitter fruit of privatization.”

Understanding WESM

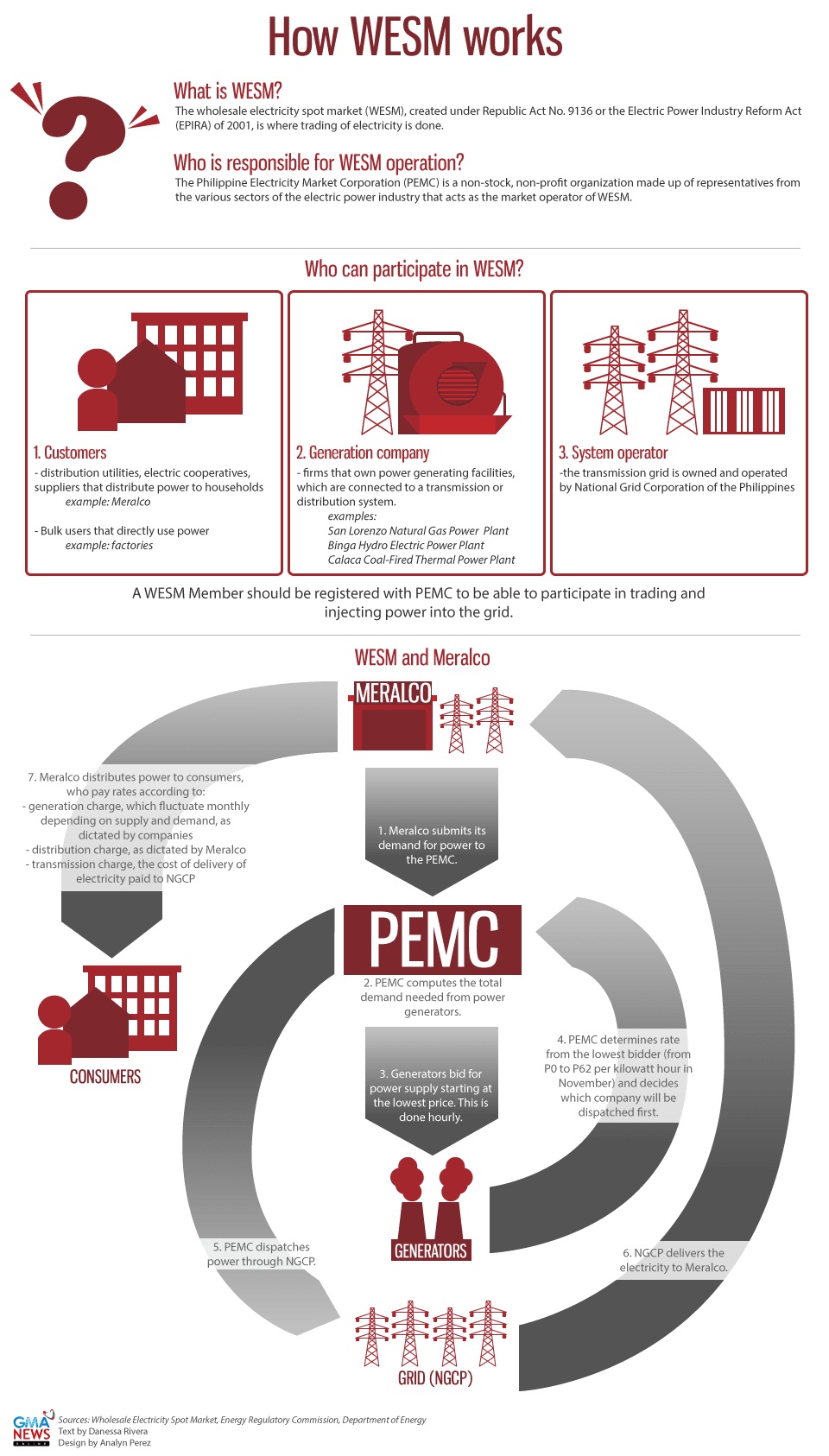

Signed by President Gloria Macapagal-Arroyo on June 8, 2001, EPIRA paved the way for the creation of the wholesale electricity spot market (WESM), a trading floor where power is bought and sold.

The law required the National Power Corporation to sell state-owned generating plants to the private sector, transferring to them the burden of financing for construction, operation, and maintenance. The move was expected to trigger competition and attract more investments in the power industry.

The Energy Regulatory Commission (ERC), an independent and quasi-judicial body that will promote competition, encourage market development, and ensure customer choice was also created.

Research Specialist Ed Fernandez of the Department of Energy’s Power Market Development Division said WESM acts as “a jar for gross pool of power from generators.”

WESM is operated by the Philippine Electricity Market Corporation (PEMC), which gives digital certificates to members. When distributors place a demand for a certain volume of power, generators place bids through WESM’s internet-based operations on an hourly basis, he explains.

“Hindi ka mag-generate to transmission kung hindi ka magbi-bid. Pababaan ang strategy and bids must equal the total demand,” Fernandez said.

Rates depend on supply

The largest power distributor in the country, Meralco blamed the rate hike on the scheduled preventive maintenance of the Malampaya natural gas line, creating a shortfall of about 2,700 MW out of its customers’ 6,000 MW average demand.

Meralco gets 90 per cent of its power requirements from generators where it has supply agreements, and the remaining 10 per cent from WESM.

However, the timing of the Malampaya shutdown from November 11 to December 10 coincided with unexplained outages of major power plants in Luzon, prompting Meralco to source more electricity from WESM players at higher rates.

“We are already investigating the matter with ERC and PEMC,” Energy Secretary Carlos Jericho Petilla told a hearing at the House of Representatives, which looked at the possibility of collusion among power plants that led to the rate hike.

Meralco has denied benefiting from the rate increase. “As a distribution utility, we only reflect the cost incurred by power producers. Hindi sa amin mapupunta ang payment but doon sa mga producers,” Meralco spokesperson Joe Zaldarriaga said.

The ERC said Meralco may implement a power rate increase on its own anytime because the computation is based on a formula the regulatory body had approved earlier. However, the steep hike had to be staggered into three tranches to be collected in December, February and March, requiring ERC’s approval.

“Rates can change from one month to the other so if there's a supply problem, it will have an impact on electricity rates,” ERC executive director Saturnino Juan said.

Higher bids from diesel plants

According to a report from Meralco, among the power plants that had outages at the same time as the Malampaya shutdown were the coal-fired plants in Sual with a capacity of 1,200 MW, GN Power with 600 MW, Quezon Power Phil. Ltd with 500 MW, Calaca with 600 MW, and Masinloc with 630 MW.

DOE’s Fernandez said the diesel plants are the ones that place high bids in WESM.

“Nag-e-enter lang sila sa market kapag down ang Malampaya or may nag-shutdown na power plant. They bid at a higher price because it is an opportunity to recover costs from the time na hindi siya tatakbo,” he explained.

In the case of suppliers with contracts, Fernandez said they are supposed to set a price only for the capacity of their plants that are not covered by contracts. “Ang nase-settle lang sa WESM, yung uncontracted supply or balance,” he said.

The case of Therma Mobile

This is why one power producer that has caught the attention of the petitioners at SC is Therma Mobile Inc. of the Aboitiz group, which placed a bid of P62/kWh even though it is fully contracted to Meralco at P8.65/kwh.

Therma Mobile operates diesel power barges moored in Navotas, which are designed to help alleviate any electric power shortfall in Luzon. During the Malampaya shutdown, the plant had an available capacity of 100 MW.

GMA News Online asked officials of Therma Mobile to explain why they placed the maximum bid, which led to the higher power prices, even though they were already obliged to supply Meralco at a much lower rate. The company declined to comment, and reiterated an earlier statement that it does not benefit from any price movement in WESM.

Last December, Aboitiz Power president and CEO Erramon Aboitiz said Meralco has full control of the Therma Mobile diesel plant’s capacity, as well as the pricing and volume, under their Power Supply Agreement. Aboitiz issued the statement in the wake of “news reports alleging that it participated in jacking up power rates in the WESM.”

The Philippine Independent Power Producers Association Inc. has also denied any collusion in the shutdown of power plants that led to a power rate hike.

“Who colluded? There are 31 generators. If somebody claims collusion, he should say who did it or how the collusion was done,” PIPPA president Luis Miguel Aboitiz said in an interview aired on GMA News’ 24 Oras. He is the president and chief executive officer of Aboitiz Energy Solutions, Inc. and senior vice president for power marketing and trading of Aboitiz Power Corporation.

“Generators have to bid at the lowest price,” PEMC president Melinda Ocampo said in a phone interview. “Kung sufficient ang supply, hindi madi-dispatch ang high-priced bids but kung insufficient ang supply, malaki ang chance na i-dispatch ang expensive power,” Ocampo added.

She declined to comment on the Therma Mobile bid, citing the pending case at the SC. – YA, GMA News